Unlock Better Refinancing Outcomes by Mastering Your LVR:

Call Fox Home Loans today, your Sunshine Coast mortgage broker, to achieve a stress-free refinance!

Understanding Loan-to-Value Ratio (LVR) and the role it plays in your refinance is key. LVR affects the terms, loan amount, rates, and repayments available for your home loan refinance, which influences your options and overall cost and savings.

Lenders use LVR to determine the percentage of your home’s value you are borrowing, ultimately having an impact on your potential savings of refinancing. In this guide, we’ll explain why LVR matters and how it influences your refinance options.

Lenders care about LVR for a refinance home loan for the same reason they do for a new loan, it helps them assess risk. Lenders will have specific LVR requirements they need to follow to ensure your refinance aligns with their risk policies.

For example, a lower LVR (below 80%) can qualify you for a lower interest rate and is considered low risk, while a higher LVR (above 80%) is considered a greater risk and comes with higher interest rates and reduced borrowing power. Higher LVR can also lead to additional fees such as Lenders Mortgage Insurance (LMI).

One of the biggest impacts of high LVR is Lenders Mortgage Insurance. LMI is a type of insurance that protects the lender, not you as a borrower. This is applied to your loan as an additional fee which is included in your finance amount and can reduce your borrowing power and increase the cost of your loan. This is typically applied when LVR is above 80% and even if you paid for LMI on your first loan, you could potentially pay it again.

Greater LVR will also affect your interest rate as lenders will increase your rate to compensate for the additional risk they are taking on.

To take control of your refinancing options, it’s beneficial to know how to calculate your LVR as this will give you a clearer picture of where you stand with your home loan refinance options.

Calculating your LVR is helpful for understanding your borrowing power, interest rates, and whether you’ll need to pay LMI. You don’t need a special LVR calculator, all you need to do to calculate your LVR is:

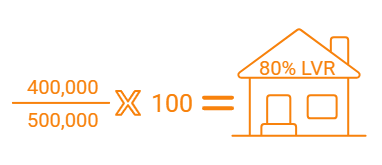

Using these two values, simply follow the equation/scenario below to roughly calculate your LVR:

If you’re refinancing a $400,000 loan on a property valued at $500,000:

To avoid the delays of waiting for a bank valuation or appraisal on your property, contact our team today who will provide you with a free property valuation as part of our home loan process.

We know how frustrating it can be to deal with a high LVR and not know how to improve it. The good news is there are effective strategies to lower your LVR and significantly increase your chances of getting your home loan refinance approved.

Explore more strategies to improve your LVR before refinancing.

Our Head of Home Loans, Bill Robb, who has 26 years of industry experience, shared an example of his team’s expertise when it comes to effectively tackling LVR while refinancing.

Recently our team were able to identify a solution for a customer that not only refinanced their current loan but also consolidated additional debt. We were able to keep the loan under 80% LVR and reduce their interest rate from 6.64% to 6.19%, while reducing their overall monthly repayments by $1300 per month. This created additional cash flow for the client as they were wanting to allocate funds to future investments.

|

Rowdie Lang |

Rowdie has been a part of our Team since 2020. He has witnessed firsthand the ongoing evolution of the finance industry as technology continues to change the way customers' access financial services. He has a passion for helping people and relishes the opportunity to work alongside our teams every day as they help our customers financial dreams come true. |

|

Reviewed by: Bill Robb ✅ Fact checked 📅 Last updated: Aug 29, 2025 |

|